The Central Bank of Nigeria, CBN, has said that it issued N40.67bn loans to members of its staff as of December 2022.

This was according to the apex bank’s audited financial statement for 2022.

It was gathered that there was an increase of 133.07 per cent from N17.43bn in 2021 to N40.67bn in 2022.

CBN did not provide details on the number of staff members who were beneficiaries of the loan.

However, information on its website provided insight into the bank’s current staff strength.

The apex bank said, “From a bank-wide staff strength of 10,000 staff, excluding the over 2,000 casuals in the HQ and branches as at 1999, the bank operates with a substantially reduced staff strength of and (sic) 4,914 by December 2005, further down from 6,119 as at December 2004. It should be noted further that 79 percent of current staff are now professionals.”

The high debt was recorded despite the N155.63bn provided as staff allowances in 2022.

According to the report, the staff allowances included furniture, housing, leave, transport, productivity allowances and ‘others paid to staff during the period’.

The figure was N90bn higher than CBN’s recorded profit of N65.63bn within the period examined.

It was also 37.2 per cent more than the N113.35bn spent on staff allowances in 2021.

It was further observed that the CBN spent a total of N1.2tn on personnel costs in seven years and recorded a net income of N520.04bn.

The highlights of the apex bank’s audited financial accounts for seven years from 2016 to 2022 released showed a sharp decline and recovery in its profit between 2016 and 2022.

This was as staff emoluments steadily rose by 119 per cent over the seven-year period.

According to the consolidated and separate statements of accounts of the apex bank that was just released, profit had declined sharply from N124.47bn and N107.39bn in 2016 and 2017 to N43.77bn in 2018.

It further declined to N34.63bn, N30.81bn in 2019 and 2020 before rising to N75.12bn in 2021.

At the end of the 2022 financial year, profit for the year of the apex bank jumped to N103.85bn, just as during the seven-year period, staff emoluments had consistently been on the rise, with N121.23bn spent on personnel expenses in 2016, rising to N135.95bn in 2017 and N137.36bn in 2018.

The amount spent on staff salary, allowances and benefits continued to rise to N168.03bn, N183.60bn and N200.04bn in 2019, 2020 and 2021 before settling at N265.87bn last year.

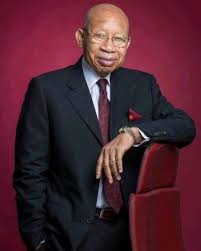

The latest result, which was signed by the suspended governor of the bank, Godwin Emefiele, and audited by Ernst & Young and KPMG, showed that credit loss expense for the banking regulator increased to N875.2bn in 2022 from N498.2bn in 2021.